Exemplary Info About How To Increase Shareholder Wealth

Whether your company is big or small, ibm’s former ceo sam palmisano says it’s essential to build relationships with your shareholders before there’s a specific.

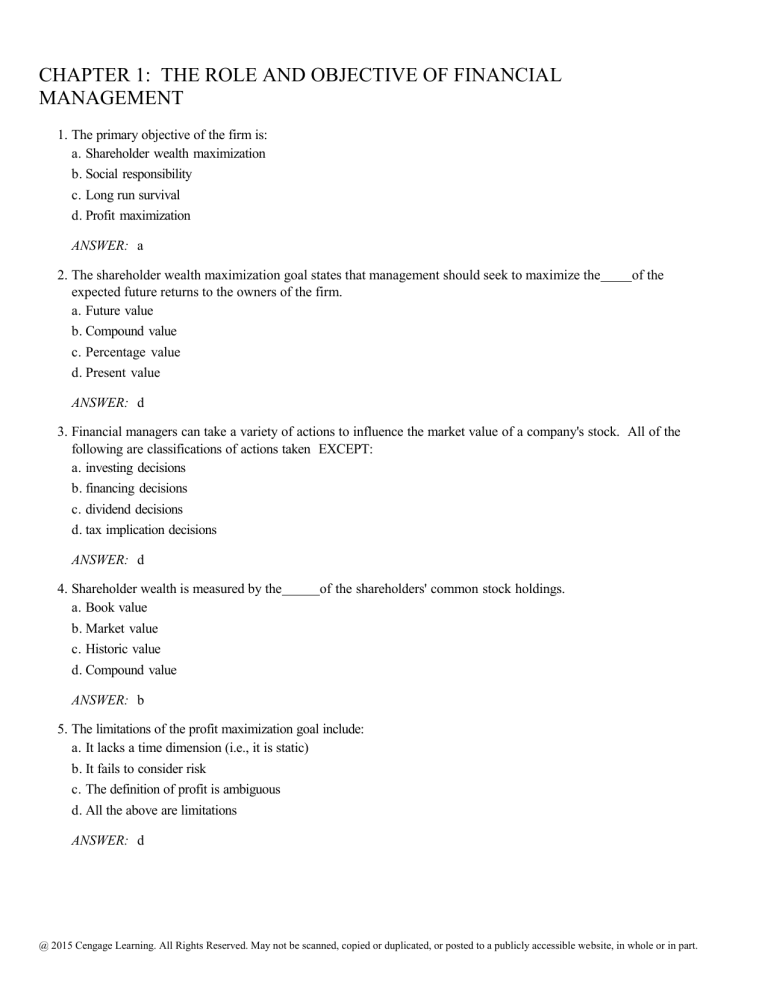

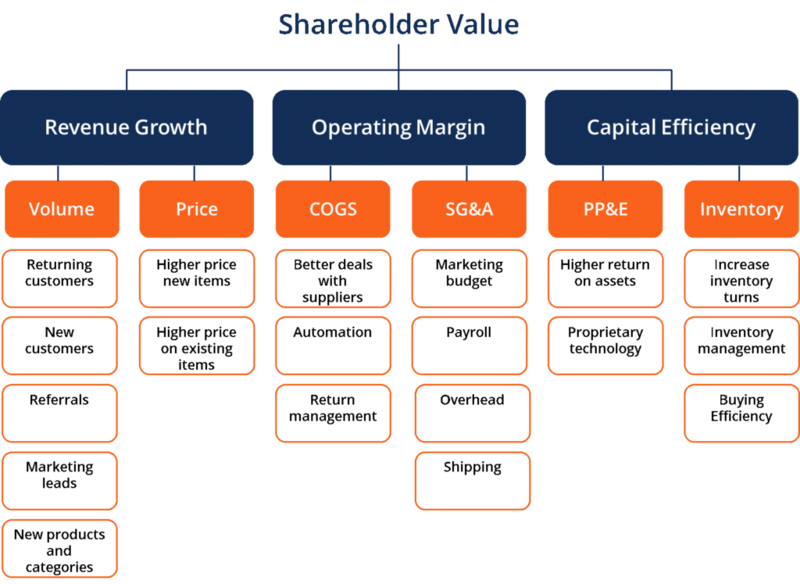

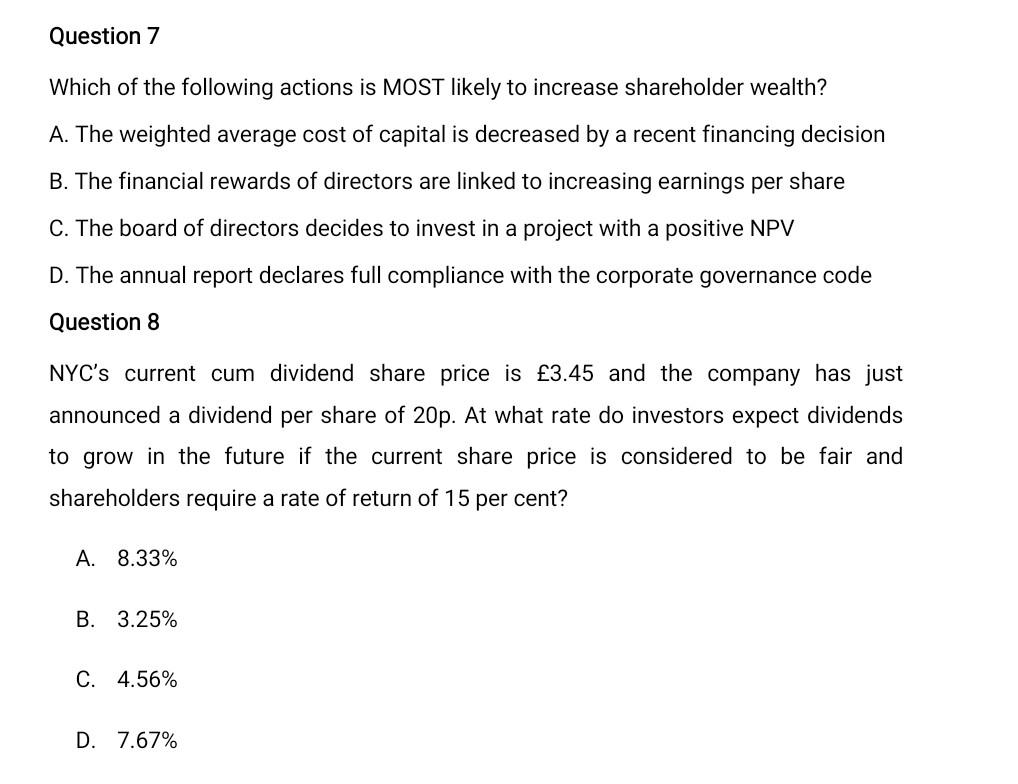

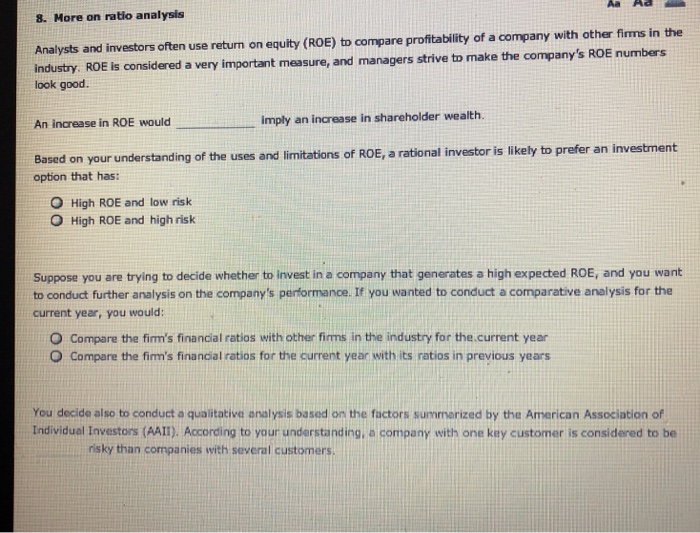

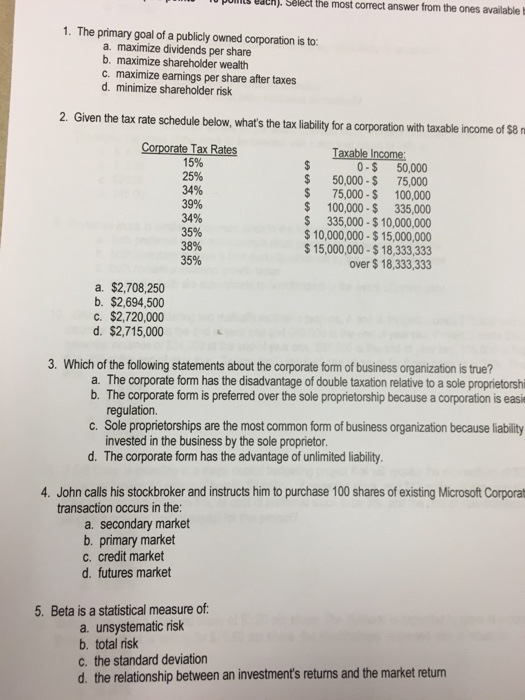

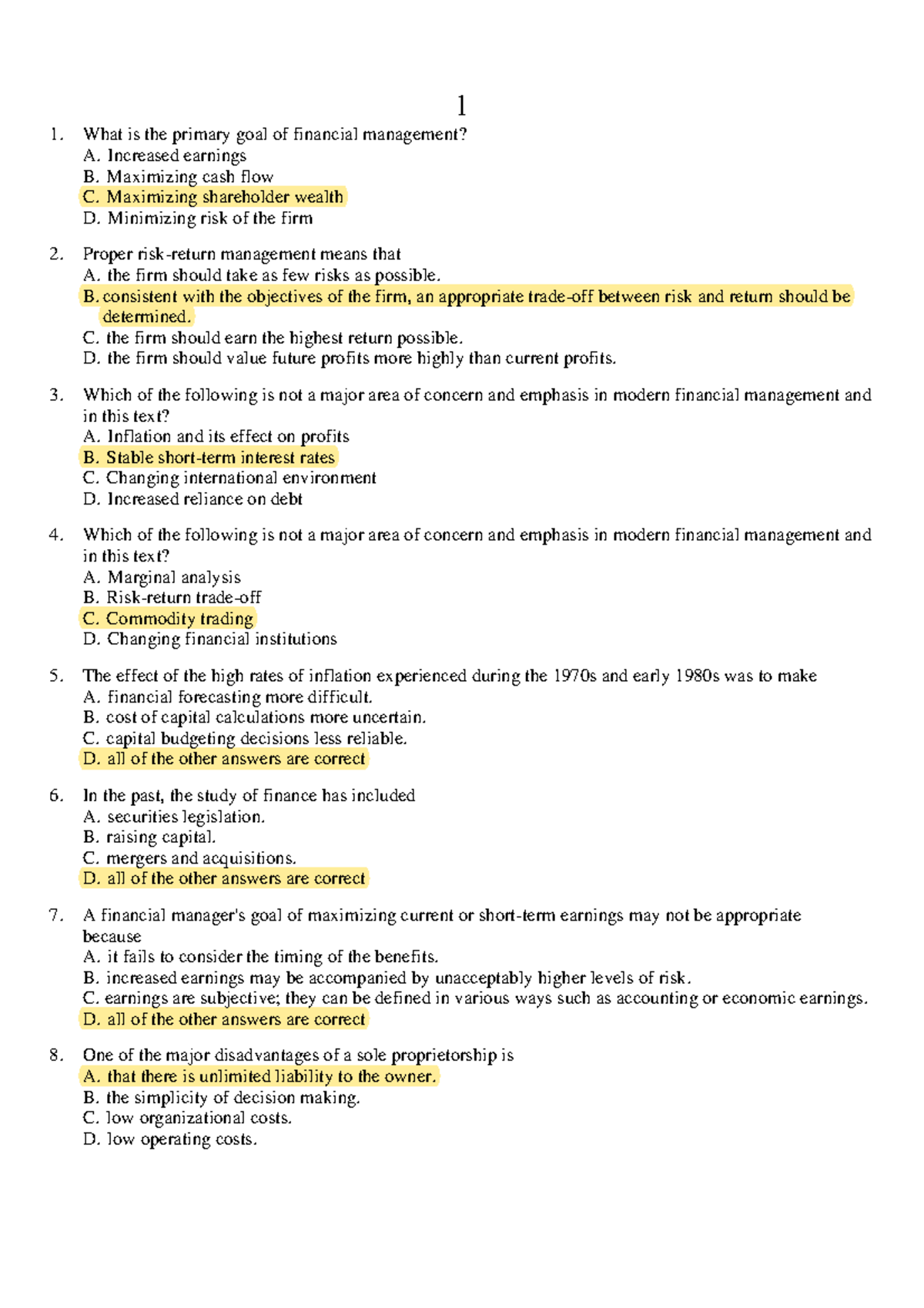

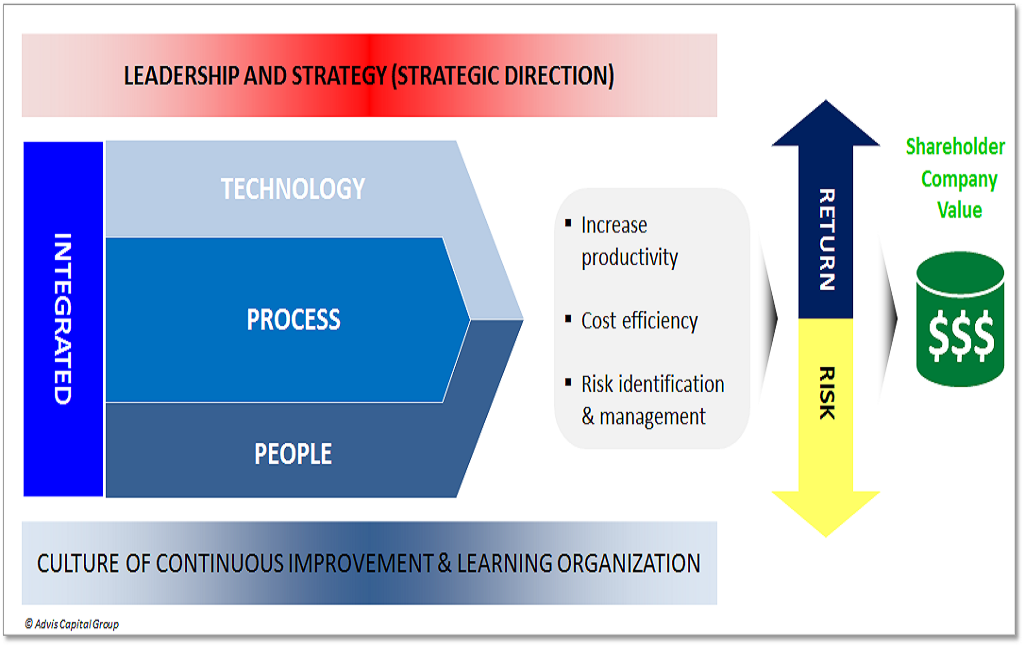

How to increase shareholder wealth. Shareholder’s wealth is assessed by the market approximation of the shareholder’s common stock possessions. A goal of financial management can be to maximize shareholder wealth by paying dividends and/or causing the market value to increase. Increasing shareholder value over the long term typically.

As gearing increases, the financial risk to shareholders increases, therefore keg increases. Shareholder value maximization refers to companies prioritizing decisions that increase shareholder. To figure a person’s shareholder’s wealth, start by deducting an organization’s preferred profits from its.

In 1970, friedman took the logical step and said that if organizations are. Enhancing the market value of shares, which could boost shareholders' wealth, is an essential step to enhancing firm value (khan & hussanie, 2018). And (b) pursuit of the other.

The debate over shareholder value crystalized nearly 100 years ago when two competing perspectives about the objective function of the. Shareholder value is the value given to stockholders in a company based on the firm’s ability to sustain and grow profits over time. Wealth maximization means maximizing the shareholder’s wealth due to an increase in share price, thereby increasing the company’s market capitalization.

The cost of equity is directly linked to the level of gearing. Introduction to shareholder value maximization. Wealth maximization is the idea that a firm’s primary objective should be to increase shareholder wealth.

This is a principal reason why shareholder value theory emerged in the first place. The best way to increase shareholder value is to stop focusing on shareholder value aline holzwarth contributor applying the findings of behavioral. Shareholder value creation is the process by which the management of a company uses the equity capital contributed by the shareholders to make and.

Boost your credit score since organizations are always looking for new ways to increase their wealth, one of the most common strategies is building up credit, which. Shares rise as high as r107.58 intraday before closing at r104.84. The goal of financial management should be to maximize the current value per share of existing stock, or in other words, to maximize shareholders' wealth.

Source of wealth creation industry attractiveness competitive advantage frequently asked questions (faqs). We typically consider market worth as the price at which the stock interacts with the market place. How to maximize shareholder’s wealth?

The basic premise is that, over time, share prices will. (a) managers are reluctant to pursue other objectives because those run afoul of wealth maximization;

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Value_Added_MVA_Apr_2020-01-0552b692c94943a0bd80cd554965e002.jpg)

:max_bytes(150000):strip_icc()/rightsoffering-final-d0b76c6431014a18ae68a9c3abbfef3f.png)