Impressive Tips About How To Get Out Of Fixed Interest Rates

Today's mortgage rates today, the average apr for the.

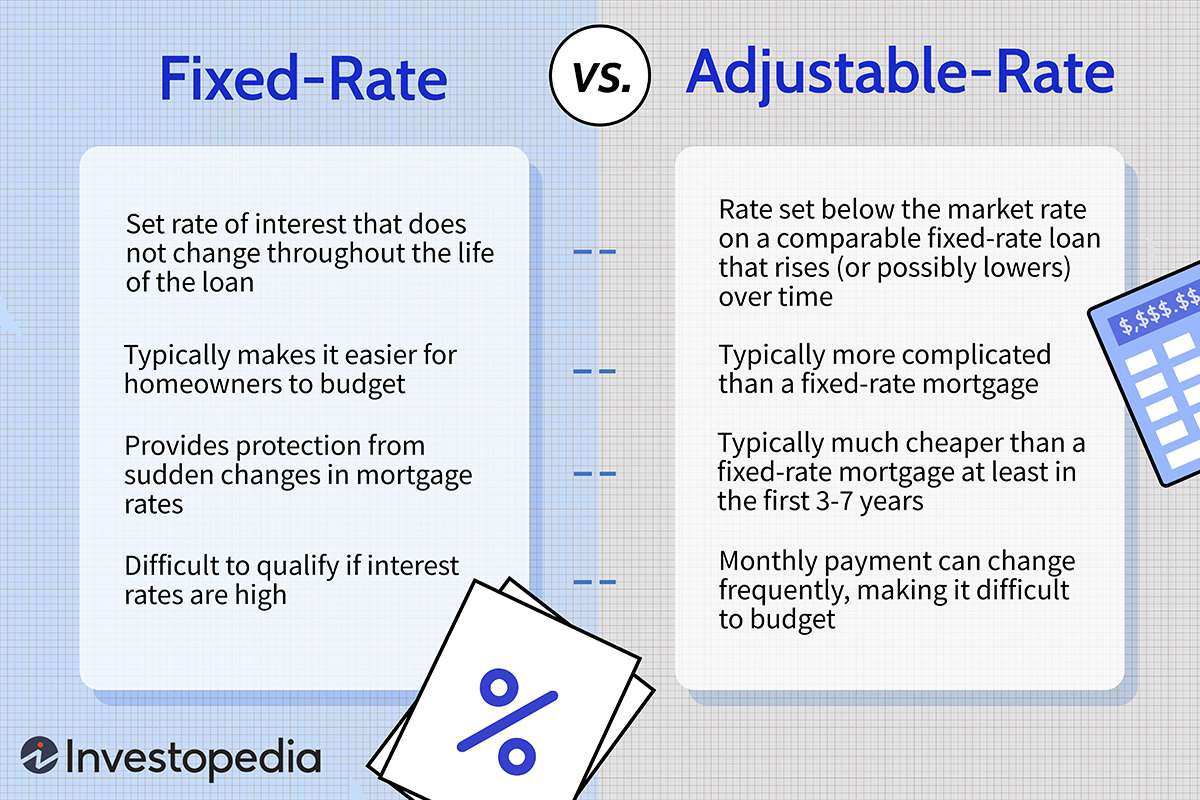

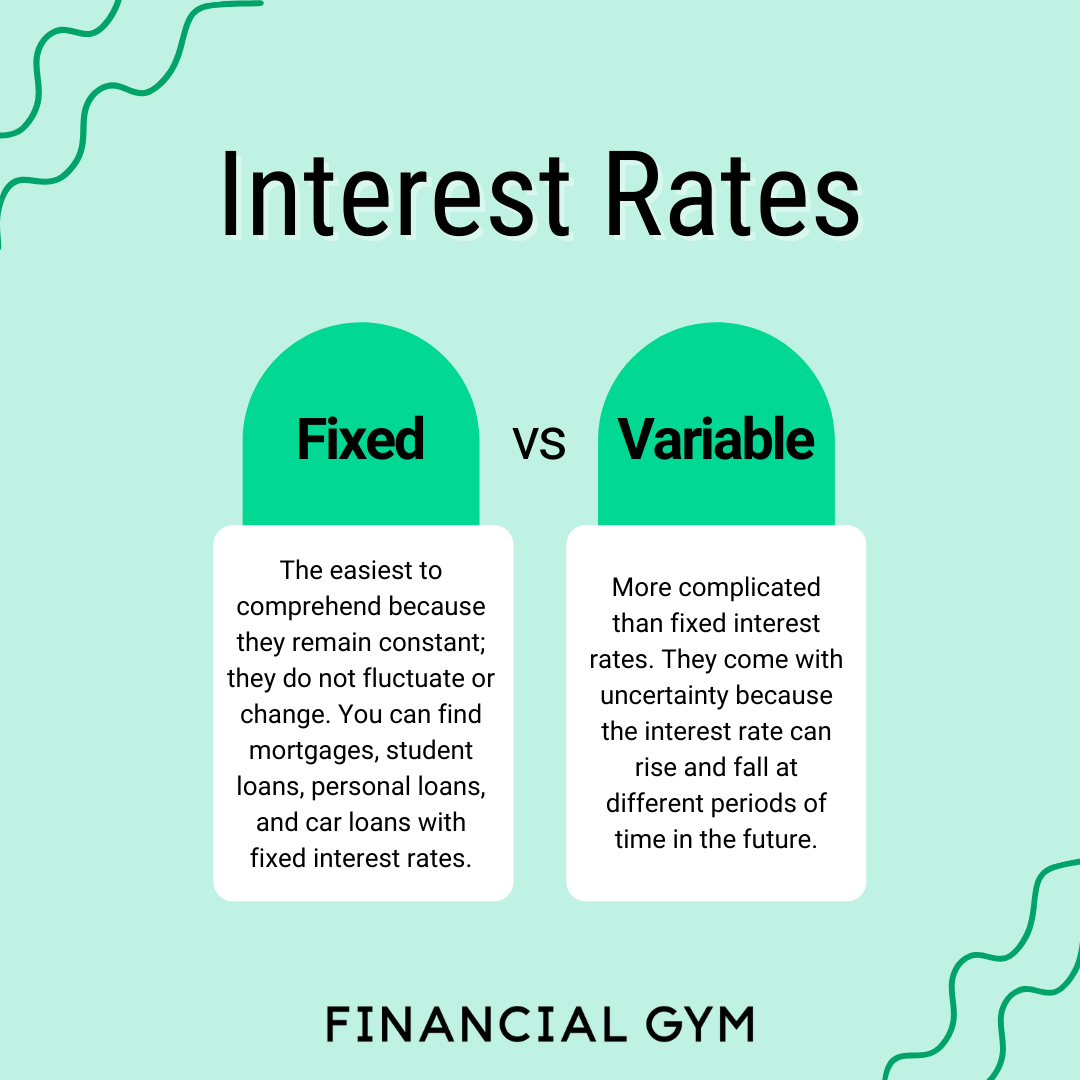

How to get out of fixed interest rates. A fixed rate loan has the same interest rate for the entirety of the borrowing period, while variable rate loans have an interest rate that changes over time. A fixed interest rate refers to an unchanging rate applied to loans and mortgages for a specified period. Simply insert your current mortgage balance, the floating interest rate you pay, and the term left on your loan.

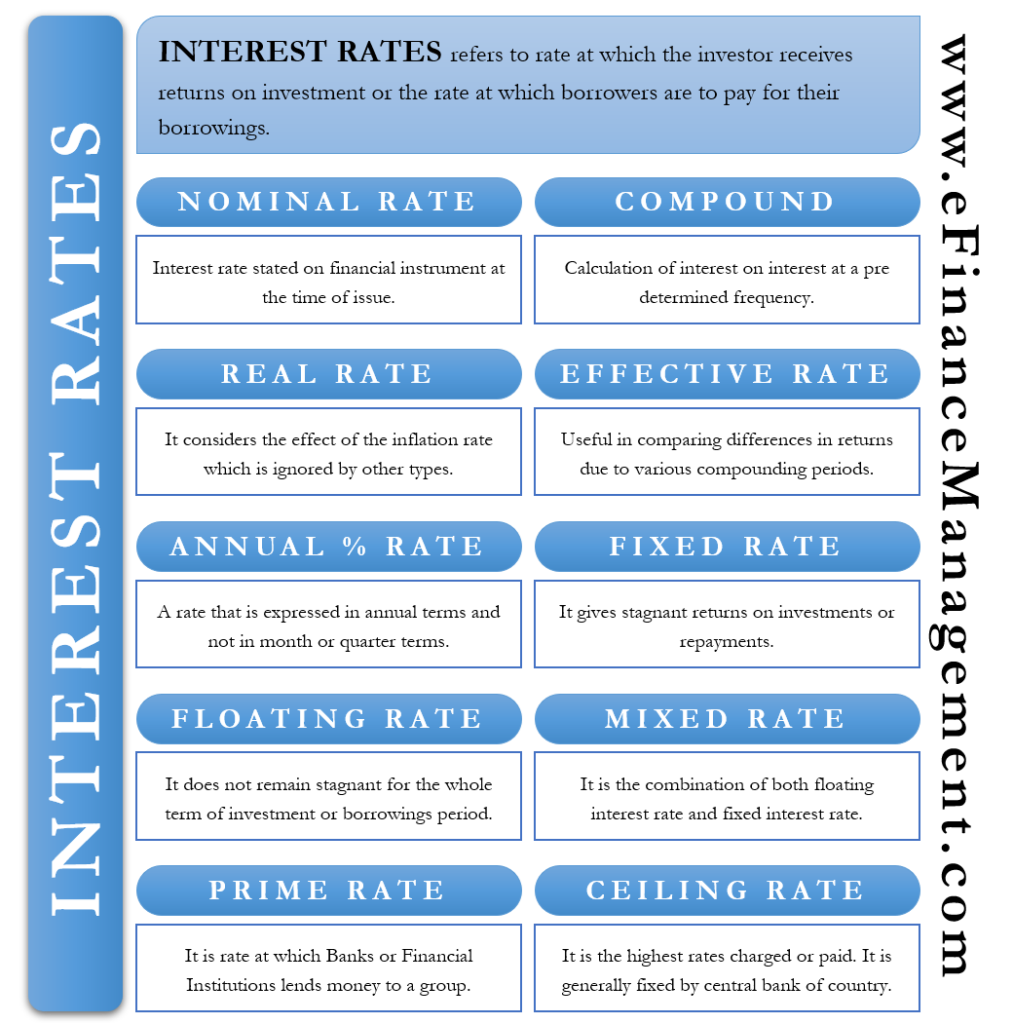

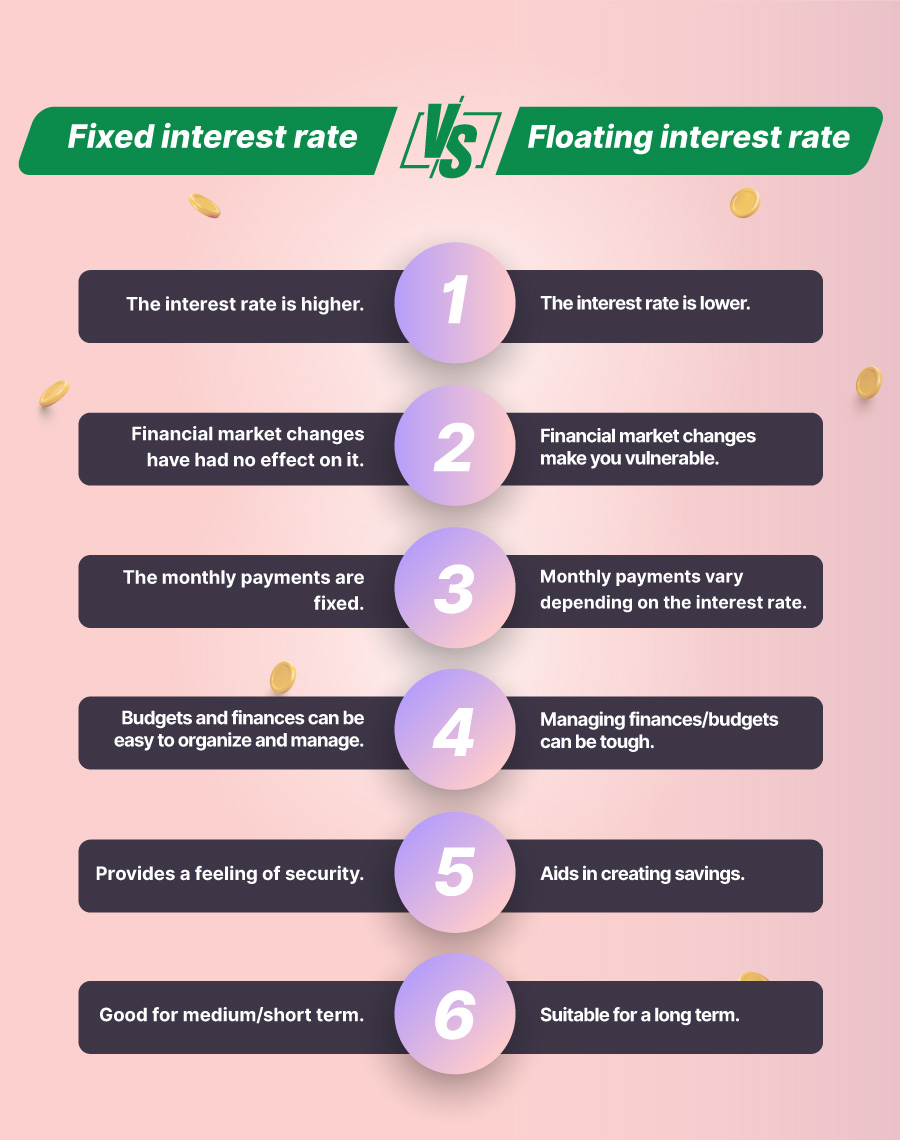

Unlike fixed pricing rates, floating rates fluctuate based on the underlying benchmark rate that is tied to the pricing of the debt (e.g. An interest rate is a percentage that is charged by a. How to get out of a fixed rate mortgage early?

Bask bank interest savings account. Because of that, they can make the necessary financial preparations to meet. You can use the fd calculator to find out or compare different rates for maturity amount, earned interest, and payouts.

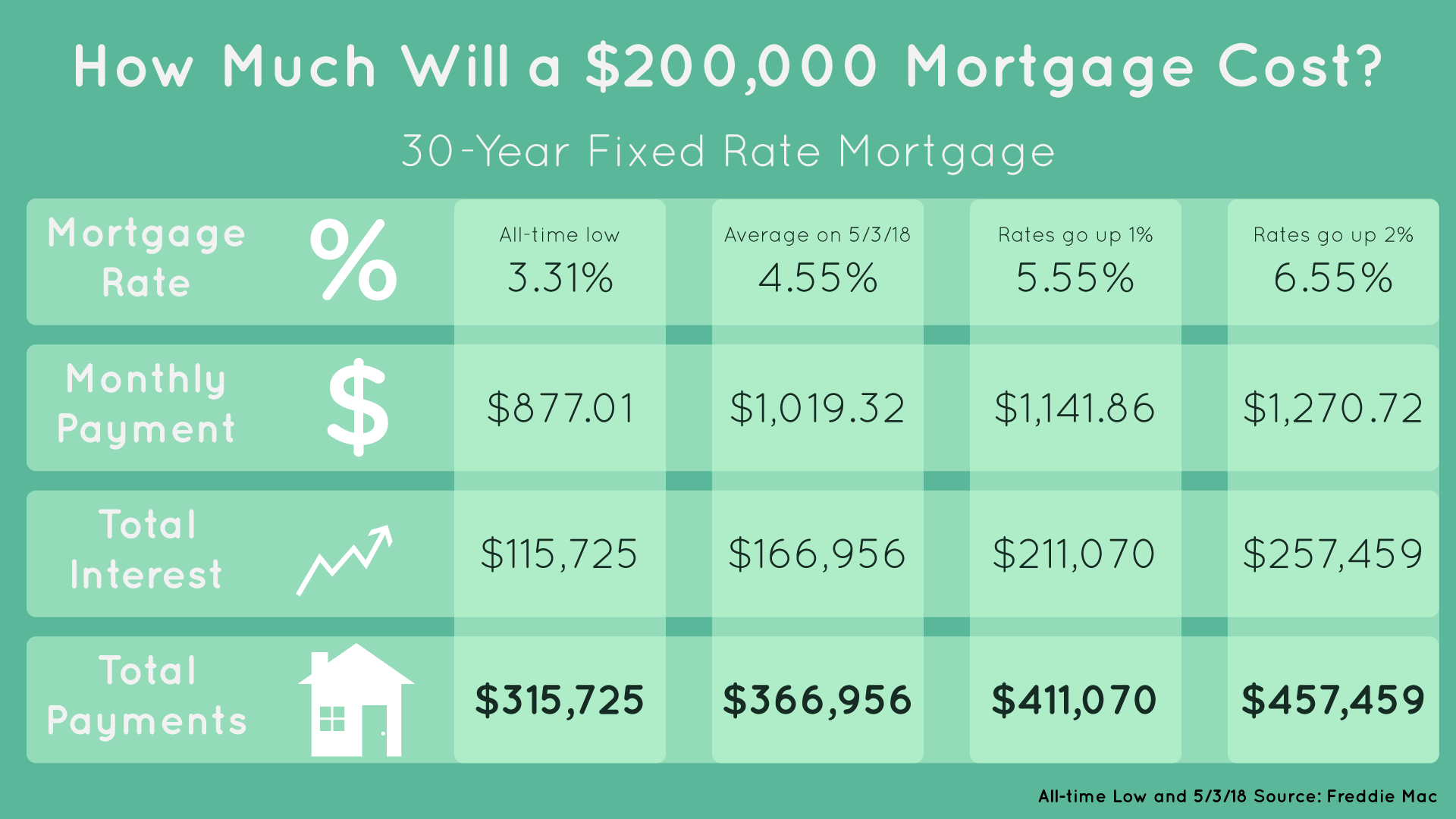

Updated jan 10, 2024. Simple interest is calculated as a percentage of principal only, while compound interest is calculated as a percentage of. Is it 15 or 30 years.

The first step to solving any problem is to acknowledge it fully. Best 5% interest savings accounts. Use our interest rate calculator to work out the interest rate you're receiving on credit cards, loans, mortgages or savings.

There are two methods for calculating interest. The relationship between the market rate and the yield on debt priced at a floating rateis as follows. Find out in seconds with moneyhub's fix or float calculator.

A fixed rate can eliminate the risk of payment shock due to rising rates. During this period, borrowers make consistent monthly payments,. It's probably not a good idea to wait for rates to fall to access your home's equity.

February 26, 2024 / 1:29 pm est / cbs news. Given these mixed signals, the direction of interest rates may depend largely on what happens with inflation. If inflation continues to ease, that will likely allow.

If the market rate declines,. And once you’ve figured that out, you need to determine what term works best for you. The federal reserve left interest rates unchanged at a range of 5.25 percent to 5.50 percent, keeping rates the highest they have been in 23 years.

A fixed interest rate is a rate that doesn’t change for the duration of your loan, or at least for a specific period. Uk banks regularly employ fixed interest rates for mortgages and. Most commentators believe the fed won’t move because the economy is growing and there are still signs that inflation hasn’t been totally beaten down.

.png?format=1500w)