Beautiful Work Info About How To Claim Tax Refund

Your tax code is a combination of numbers and letters used by hmrc to determine the amount of tax to.

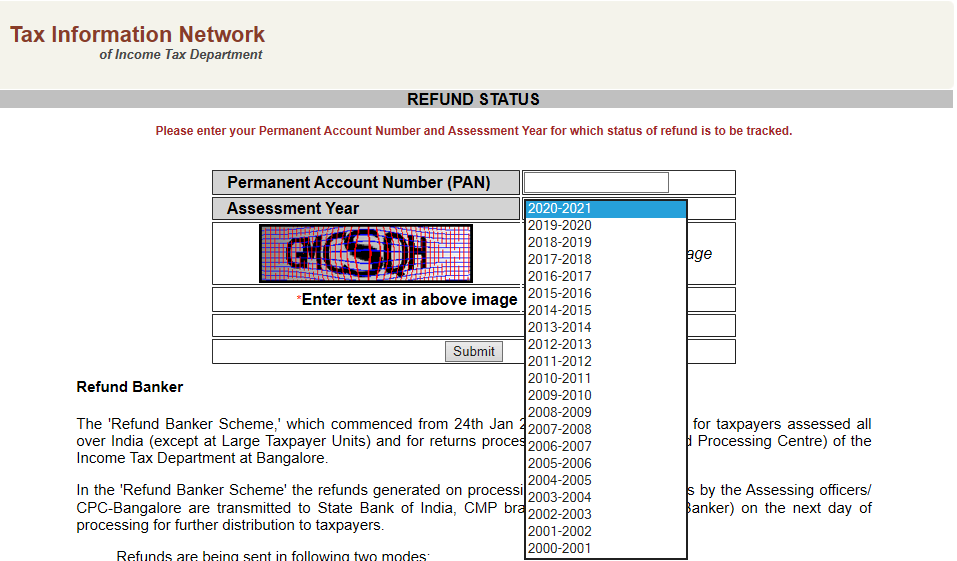

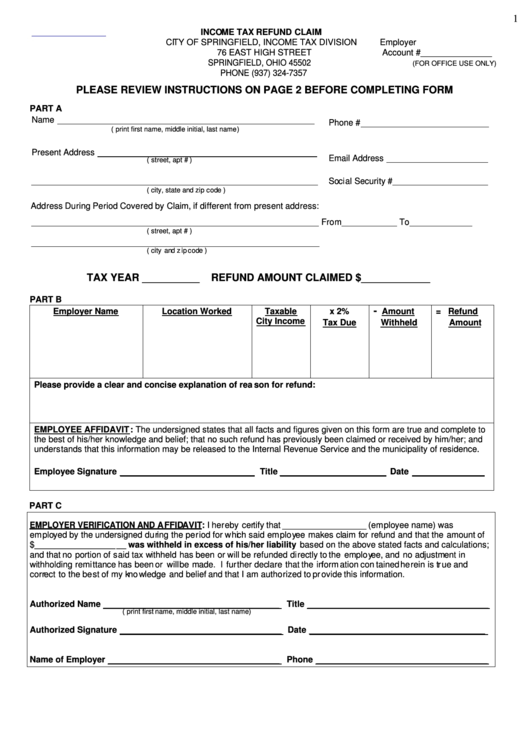

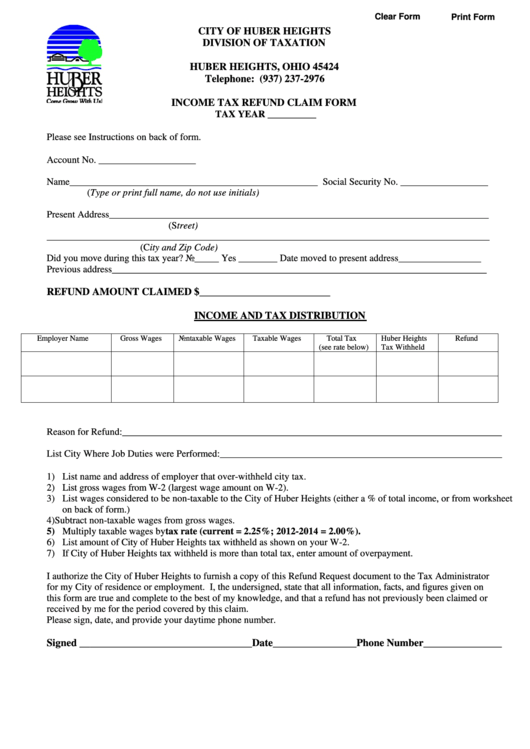

How to claim tax refund. The usual sources of tax refunds are salaries, the income of freelancers and. Log in to inland revenue to see if you have a refund. Check your federal tax refund status.

Social security number or individual taxpayer identification number (itin) filing. Online tax software can help you complete your tax return to claim a tax refund for 2021 (you can also use your phone to scan your important tax documents ),. How do i use the hmrc app to claim a tax refund?

Other general tax credits. What is an income tax refund? The first step in claiming your income tax refund is to determine if you are eligible.

As per the income tax act, a person is required to file his/her income tax return in the relevant assessment year by july 31 (unless the deadline is extended) to. If you're not taken to a page that shows your refund status, you. Need help with tax refund information?

Over the course of the. Start by verifying whether your tax code is correct. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help.

You can also check when you can expect a reply and explore the topic of income tax and. Tax refunds result from the overpayment of taxes. The cra 's goal is to send you a notice of assessment, as well as any refund, within:

Have a chat with bo and respond with yes if bo asks if you need help with your upcoming flight. The 1040 series of tax forms can be downloaded from the prior year returns link on agency's forms and publications web page or ordered by calling (800). Complete my individual tax return (ir3) check if you have a refund.

Use this tool to find out what you need to do if you’ve paid too much tax on different types of income, such as a job, a pension, a self assessment tax return or a redundancy payment. Two weeks, when you file. What to do if you haven’t filed your tax return many people may lose out on their tax refund simply because they did not file a federal income tax return.

You can also authorise a representative to claim on your behalf. How you file your return can affect when you get your refund. Go to the get refund status page on the irs website, enter your personal data then press submit.

Fill in and send the form to hmrc or. Learn about unclaimed tax refunds and what. Within 90 working days after manual submission;.