Impressive Tips About How To Buy An I Bond

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

If you buy the maximum amount of paper and electronic i bonds, you can buy up to $15,000 worth of i bonds each year.

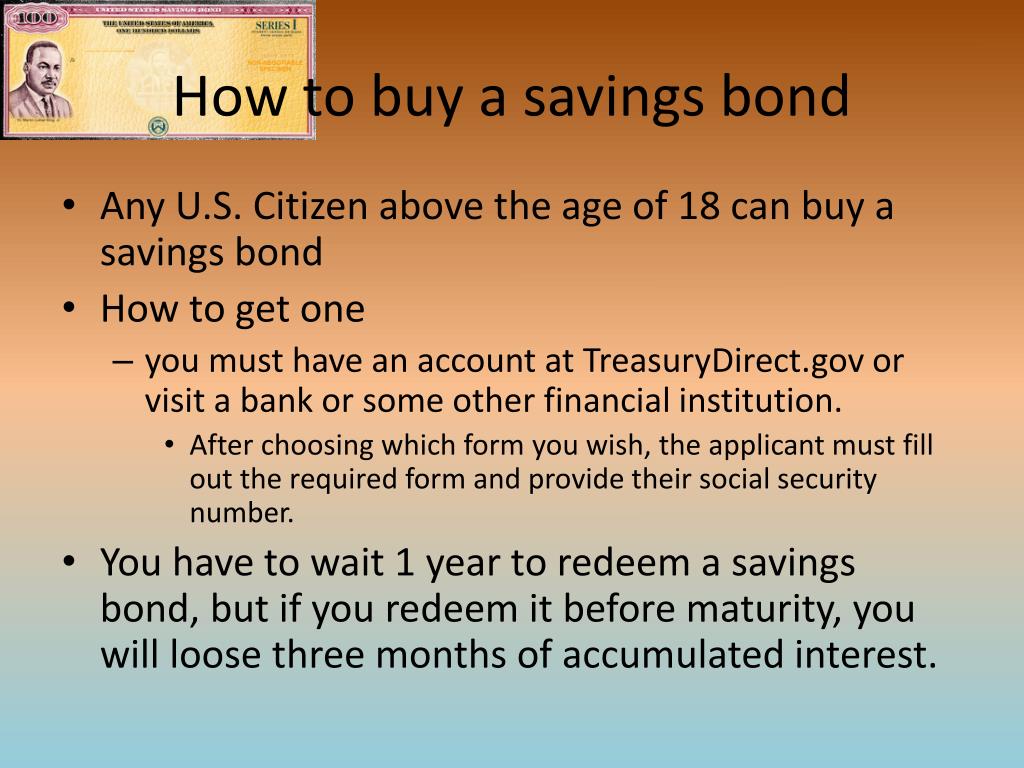

How to buy an i bond. I bonds should be balanced with other investments for a diversified. You can buy electronic i bonds on treasurydirect.gov or paper i bonds with your tax refund.

Millions of americans rushed to buy i bonds in 2022 when a. The us department of the treasury borrows from the investing public through bonds that are repaid with a set. That’s a big jump from the.

Monthly interest for i bonds is always paid on the first day of the month, and is not pro. I bonds are short for series i savings bonds. Learn how to buy electronic or paper i bonds in your treasurydirect account, and how to cash in your bond after 30 years.

They are bonds issued by the u.s. The minimum purchase amount for i bonds is $25, while the maximum amount is $15,000 in a calendar year—$10,000 in electronic bonds purchased from the. Some market pros have been eyeing the possibility rates stay high in 2024.

Unlike a regular savings bond with a fixed rate, i bond. I bonds are easy to buy online. You can buy them electronically via treasurydirect, with an individual limit of $10,000 per person per calendar year.

Written by david mcmillin edited by laura michelle davis updated jul. I bonds and ee bonds are both savings bonds issued by the u.s. Advertisement what are i bonds?

Both earn interest monthly for 30 years, and they. Treasury and purchased from treasury direct. (1 min) the tax bill is coming due for one of the hottest investments of the past two years.

Treasury bonds are one form of government debt. If your purchase exceeds that limit, it can take up to 16 weeks for. Once you’ve clicked on “buydirect” in the menu bar at the top, turning it orange, select.

If you are looking for a way to save your money and protect it from the inflation americans are experiencing, you may want to consider learning how to buy i. There are two ways to buy i bonds.

The main way is to go online using treasurydirect.gov, and the i bonds bought through this website are digital. I bonds are designed to protect your money against the corrosive effect of inflation. So based on march’s price levels relative to september’s, the yield on series i savings bonds should increase to 9.62% beginning may 1.

:max_bytes(150000):strip_icc()/Open-Market-Operations-OMO-Final-ec375b8eb4d44b4d80b7bb24c6f1c9f2.jpg)

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

-min.png)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

:max_bytes(150000):strip_icc()/bond-final-f7932c780bc246cbad6c254febe2d0cd.png)